Sustainability

Compensation for Directors and Audit & Supervisory Board Members

Alignment of Officer Compensation with Long-term Performance

Policies on Determining the Details of Compensation for Directors and Others

The compensation system for directors and others has been established for the purpose of contributing to the Group’s sustainable growth and the enhancement of its medium-to-long-term corporate value by practicing the NGK Group Philosophy and realizing the NGK Group Vision. We reassess whether the level and composition of compensation is appropriate in light of those objectives and revise it as appropriate. The Company also strives to ensure transparency and fairness in governance of compensation.

Policies on Determining the Details of Compensation for Directors and Others

(PDF:122KB)

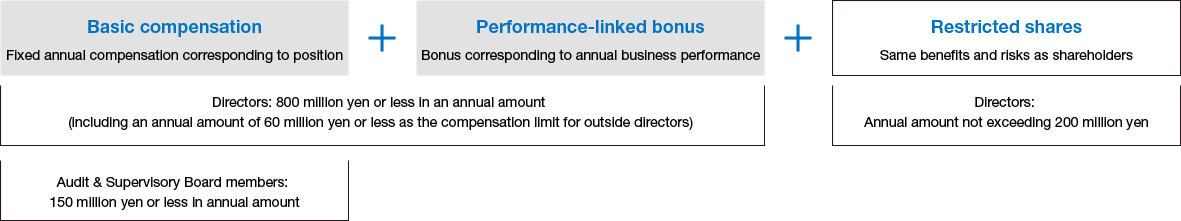

Composition of compensation for Directors, Audit & Supervisory Board Members and Executive Officers

General Meeting of Shareholders’ resolutions on officer compensation and the details of compensation

| Persons Eligible for Payment | Date and Details of the Resolution | Number of Persons Eligible for Payment at the Time of Resolution | Reference: Type of Compensation |

|---|---|---|---|

| Directors | June 28, 2007 Amount of compensation etc.: 800 million yen or less in an annual amount |

14 (including 2 outside directors) | Basic compensation and perform-linked bonuses (excluding outside directors) |

| June 29, 2017 Of the above, the amount of compensation limit for outside directors was revised from 30 million yen or less to 60 million yen or less in annual amount |

13 (including 3 outside directors | ||

| Directors (excluding outside directors) |

June 27, 2022 Total amount of monetary claims to be paid as compensation for the grant of restricted shares: 200 million yen or less in annual amount |

6 | Restricted share compensation |

| Audit & Supervisory Board Members | June 26, 2023 Amount of compensation etc.: 150 million yen or less in annual amount |

4 | Basic compensation |

NGK resolved at the General Meeting of Shareholders held on June 28, 2021 that the amount of compensation to directors (excluding outside directors) in the form of stock compensation-type stock options shall not exceed 200 million yen per year (number of directors (excluding outside directors) at the time of the resolution was six). However, at the General Meeting of Shareholders held on June 27, 2022, it was resolved to abolish the stock compensation-type stock option plan, except for those already granted, and to introduce a restricted share compensation plan in its place.

Performance-linked bonus calculation method (FY2023)

The following indicators are used in calculating the performance-linked bonus.

Distribution ratio of performance-linked bonuses by item and performance evaluation index (excluding personal evaluations)

| Item | Distribution Ratio | Evaluation Factor Change Ratio | Performance Evaluation Index |

|---|---|---|---|

| Short-term indicators | 40% | -100% to +100% |

Consolidated performance (net sales, operating income and net income):

|

| -100% to +100% |

Return on invested capital:

|

||

| Medium- to long-term indicators | 60% | -100% to +100% |

Medium- to long-term performance targets (operating income):

|

| -100% to +100% |

Level of achievement for key issues (creation of new products and businesses—Keep Up 30 and CO2 emission reduction initiatives, etc.) |

Non-monetary Compensation etc.

Non-monetary compensation

NGK grants restricted share compensation to directors (excluding outside directors) and executive officers (excluding executive officers who are overseas residents on a non-temporary basis) in order to increase their sensitivity to stock price, to further share with shareholders the benefits and risks associated with stock price fluctuations, and to motivate them to improve corporate value over the medium to long-term. Since stock price fluctuations are directly related to its value, the amount of restricted shares is not fixed, but the number of shares granted is fixed in accordance with the position.

NGK revised the officer compensation system at a meeting of the Board of Directors held on April 28, 2022. At the 156th Ordinary General Meeting of Shareholders held on June 27, 2022, it was resolved to abolish the stock compensation-type stock option plan, except for those already granted, and to introduce a restricted share compensation plan in its place. An overview of the restricted share compensation we granted in FY2023 is as below.

| Overview of Restricted Share Compensation | |

|---|---|

| Class and number of shares to be issued | The Company’s common stock: 127,000 shares |

| Issue price | 1,714 yen per share |

| Aggregate issue amount | 217,678,000 yen |

| Persons eligible for the allotment of the shares and the number thereof, as well as the number of shares to be allotted | The Company’s directors (excluding outside directors): 6 persons, 43,000 shares executive officers who do not concurrently serve as the Company’s directors: 24 persons, 84,000 shares (excluding executive officers who are overseas residents on a non-temporary basis) |

Period of the transfer restriction stipulated in the restricted share allotment agreement (hereinafter “the Allotment Agreement”):

The allottees must not transfer, establish as security interests or otherwise dispose of the Company’s ordinary shares allotted to them according to the Allotment Agreement from the date on which they receive their allotment according to the Allotment Agreement to the point in time directly after retiring from the position determined in advance by the Company’s Board of Directors from among the positions of the Company’s officers and employees.

Claw back clause

NGK has a provision to acquire all of the accumulated allotted stocks without compensation in the event that the allottee of the restricted shares violates laws and regulations during the period of the transfer restriction, or in the event that certain other conditions stipulated in the allotment agreement are met.

Stock holding guideline for Directors and Executive Officers

In order to foster a sense of shared value between directors and executive officers and shareholders, and to contribute to the sustainable growth of the NGK Group and the enhancement of its corporate value over the medium to long-term, NGK has established guidelines for holding its own stock, etc.*1 and in principle, within three years of assuming office, directors and executive officers shall endeavor to hold company stock, etc. equivalent to the following values.

1: Includes stock compensation-type stock options that have not yet reached the exercise commencement date.

| Persons Eligible | |

|---|---|

| Directors (Chairman and President) | 150% or more of basic compensation (annual amount) |

| Directors*2 and Executive Officers*3 | 100% or more of basic compensation (annual amount) |

2: Excluding Chairman, President, and outside directors

3: Excluding executive officers who are overseas residents on a non-temporary basis

Amount of Compensation for Directors and Audit & Supervisory Board Members

Compensation for Directors and Auditor & Supervisory Board Members (FY2022)

| Director category | Total compensation (million yen) |

Total compensation by type (million yen) |

Applicable officers (people) |

|||

|---|---|---|---|---|---|---|

| Fixed Compensation | Performance-linked compensation | Restricted share compensation | Stock compensation-type stock options | |||

| Directors (excluding Outside Directors) |

539 | 301 | 161 | 58 | 18 | 7 |

| Outside Directors | 42 | 42 | ‒ | ‒ | ‒ | 3 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

69 | 69 | ‒ | ‒ | ‒ | 2 |

| Outside Audit & Supervisory Board Member | 28 | 28 | ‒ | ‒ | ‒ | 3 |

Notes:

- The total amount of compensation for directors (excluding outside directors), the total amount of compensation by type, and the number of applicable officers noted above include one director who resigned from his position on June 27, 2022 and the amount of compensation he received.

- The total amount of compensation for outside Audit & Supervisory Board members, the total amount of compensation by type, and the number of applicable officers noted above include one outside Audit & Supervisory Board member who resigned from his position on June 27, 2022 and the amount of compensation he received.

- At the 156th Ordinary General Meeting of Shareholders held on June 27, 2022, it was resolved to abolish the stock compensation-type stock option plan, except for those already granted, and to introduce a restricted share compensation plan in its place. Accordingly, we did not grant new stock options in FY2022. However, we have stated the amount of compensation recorded as expenses in FY2022 for those stock options we granted in the past fiscal year.

Officers receiving total compensation of ¥100 Million or More (FY2022)

| Name | Officers category | Company category | Total compensation by type (million yen) | Total compensation (million yen) | |||

|---|---|---|---|---|---|---|---|

| Fixed compensation | Performance-linked compensation | Restricted share compensation | Stock compensation-type stock options | ||||

| Taku Oshima | Director | Submitting company | 67 | 40 | 13 | 4 | 125 |

| Shigeru Kobayashi | Director | Submitting company | 67 | 40 | 13 | 4 | 125 |

Average Employee Compensation and President Compensation

At NGK, the compensation for the President was 15.2 times that of the average employee compensation in FY2022.

(FY2022)

President compensation: 125,000,000 yen

Average employee compensation: 8,240,174 yen