Sustainability

Nomination and Compensation for Directors and Audit & Supervisory Board Members

Matters Related to Nomination, Appointment and Dismissal

Policy on Nomination, Appointment, and Dismissal

The NGK Group is mainly engaged in the business of manufacturing materials such as ceramics and related products for supply to a wide range of areas, including overseas. The executive management, including representative directors, directors with special titles, directors in charge of business execution, and corporate officers is appointed without regard to gender, age, nationality, or race. They are required to make management decisions and other decisions based on their detailed knowledge of business in each NGK Group business area, specialized knowledge of manufacturing technology and R&D, and knowledge of finance, legal affairs, labor, and other areas. Full-time Audit & Supervisory Board members must also perform audit responsibilities based on professional expertise in finance and other areas, and knowledge gained from individual business experience. For these reasons, we focus on two kinds of expertise when nominating candidates for the positions of director and full-time Audit & Supervisory Board member. One is practical experience and leadership in manufacturing technology, R&D, sales, planning, overseas business, and other business areas. The other is expertise in finance, legal affairs, labor, information and telecommunications, and other subjects. For outside directors and outside Audit & Supervisory Board members, we nominate candidates from among a pool of human resources who possess professional expertise in legal affairs, corporate finance, or other areas, or discernment into international affairs, social and economic trends, trends in technology, and corporate management.

When selecting candidates for the positions of representative director and director with a special title, we focus on candidates who possess insight into NGK Group issues and the ability to formulate corrective measures, and who possess the leadership to express the vision of the NGK Group and drive the organization. When a member of executive management has committed a serious violation of local/national laws and regulations, the Articles of Incorporation, and other NGK Group rules, or has engaged in acts that seriously affect business execution, NGK will dismiss that individual upon receiving a recommendation that dismissal is appropriate from the Nomination and Compensation Advisory Committee and obtaining approval by resolution of the Board of Directors.

The Nomination and Compensation Advisory Committee, which has independent directors as a majority of its members, deliberates on this policy and reports its conclusions to the Board of Directors.

Procedures for Nomination, Appointment, and Dismissal

When nominating candidates for the positions of director and Audit & Supervisory Board member, all representative directors discuss each candidate and obtain consent from the Audit & Supervisory Board for Audit & Supervisory Board member candidates. In addition to this, NGK strives to ensure fairness, transparency, and timeliness in the process of nomination, appointment, and dismissal. This is accomplished through deliberation on the nomination of each candidate for director and Audit & Supervisory Board member, and appointment and dismissal of representative directors and directors with special titles by the Nomination and Compensation Advisory Committee, which has independent outside directors as a majority of its members. The committee then reports its detailed conclusions to the Board of Directors. After the Board of Directors has sufficiently considered the conclusions of the committee, the Board elects candidates for the positions of director and Audit & Supervisory Board member, and approves this as an agenda item (resolution) for the General Meeting of Shareholders. After directors are elected by the General Meeting of Shareholders, the Board of Directors appoints representative directors and directors with special titles, based on the report by the Nomination and Compensation Advisory Committee.

Conclusion of Limited Liability Contract

At the 140th Ordinary General Meeting of Shareholders held on June 29, 2006, NGK amended its Articles of Incorporation to allow outside directors and Outside Audit & Supervisory Board members to enter into limited liability contracts so as to more fully carry out their expected roles.

The following provides an overview of the contents of the limited liability contract that NGK has concluded with all outside directors and outside Audit & Supervisory Board members in accordance with our Articles of Incorporation.

(Overview of Limited Liability Contract for Outside Directors and Outside Audit & Supervisory Board Members)

Concerning the liability as set forth in Article 423, paragraph 1 of the Companies Act, upon entering into this contract, outside directors and Outside Audit & Supervisory Board members must bear only the minimum liability stipulated by Article 425, Paragraph 1 of the Companies Act, provided that they have performed their duties in good faith and without gross negligence.

Even after entering into this contract, outside directors and Outside Audit & Supervisory Board members shall carry out their duties objectively and from a neutral standpoint.

State of D&O Liability Insurance

NGK has entered into a D&O liability insurance agreement with directors and other personnel. The details are as follows. The Board of Directors will reach a resolution concerning conclusion of the current contract on June 26, 2025.

- Scope of Persons Insured

All NGK directors, Audit & Supervisory Board members, and executive officers - Summary of Insurance Policy Contents

This policy provides compensation for damages and dispute expenses incurred by the insured person due to claims for damages that result from actions (including omissions) performed by the insured person in connection with their duties as an officer of NGK. However, we have taken measures to ensure the actions taken by officers and other personnel in the service of their duties are appropriate. Thus it does not provide compensation for damages caused by the illegal acquisition of personal profits or benefits, criminal actions, or actions taken with the knowledge that they are illegal. All insurance premiums are borne by NGK.

Criteria for Determining Independence of Outside Officers

Outside Directors

In addition to the requirements for an outside director under the Companies Act and for an independent director specified by the Tokyo Stock Exchange, NGK may not designate a person who falls under any of the following items as an outside director with independence (hereinafter referred to as the “Independent Outside Director”). Even if a person falls under one or more of these items, NGK may make an exception and deem a person suitable for serving as an Independent Outside Director of NGK in light of his or her character, knowledge, and other attributes. However, the person must still meet the requirements of the Companies Act and Tokyo Stock Exchange and the Company must provide an external explanation of why such person is suitable to serve as an Independent Outside Director of NGK.

In these standards for determining independence, a business executive refers to an executive director, executive officer, corporate officer or other employee, and the NGK Group refers to NGK and its subsidiaries or affiliates.

- A major shareholder who holds 10% or more of current voting rights in NGK, or who was a business executive of the corporation if the major shareholder is a corporation during the past three fiscal years, including the most recent fiscal year.

- A current business executive of a business partner of the Company which has engaged in transactions with the NGK Group totaling 2% or more of consolidated net sales for either party in any of the last three fiscal years, including the most recent fiscal year.

- A person who was a business executive in a corporation that is a financial institution or other major creditor which is absolutely essential in financing the NGK Group and for which no alternatives exist, during the past three fiscal years, including the most recent fiscal year.

- A current director or officer of an organization that has received donations or grants totaling 10 million yen/year or 30% of total average annual expenses of the organization, whichever is greater, from the NGK Group in any of the past three fiscal years, including the most recent fiscal year.

- A certified public accountant (CPA) or tax accountant, or a current employee of an accounting firm or tax accounting firm who served as an accounting auditor or accounting advisor of the NGK Group during the past three years, including the most recent fiscal year.

- An attorney, certified public accountant, tax accountant, or other consultant who does not correspond to any of the individuals mentioned above in 5, who received 10 million yen/year or more in cash and other assets in addition to officer compensation from NGK Group during the past three years, including the most recent fiscal year, or who does not correspond to any of the individuals mentioned above in 5 and is a current employee, etc. of a law firm, accounting firm, tax accounting firm, consulting firm, or other organization that provides expert advice, and that organization has received payments from the NGK Group totaling 2% or more of total consolidated net sales in any of the past three fiscal years, including the most recent fiscal year.

- A person who was a business executive in a company in which NGK is currently a major shareholder, during the past three fiscal years, including the most recent fiscal year.

- A spouse or relative within the second degree of kinship of anyone to whom the preceding items 1 through 7 apply.

Outside Audit & Supervisory Board Members

In order to ensure that outside Audit & Supervisory Board members are impartial and that there is no conflict of interest with our general shareholders, NGK makes comprehensive decisions based on the Securities Listing Regulations of the Tokyo Stock Exchange.

Reasons for Individual Appointments

Outside Directors

| Name | Reasons for appointment |

|---|---|

| Emiko Hamada | Ms. Emiko Hamada has made remarkable achievements such as leading the invention and the world’s first commercialization of the CD-R (recordable CD) while working for Taiyo Yuden Co., Ltd. Since then, she has been engaged in research activities mainly through industry-academia-government collaborations as Professor at Nagoya Institute of Technology and Visiting Professor at Nagoya University. The Company expects her to oversee the management of the Company from an independent, objective standpoint based mainly on the perspective of research, development, and product commercialization, by utilizing the insights she has developed through her career. In addition, she has been appropriately fulfilling her duties as an Outside Director of the Company by giving her opinion in terms of ways to proceed with product development and new business and also on human resources measures, as well as offering suggestions to the Company’s business operation and overseeing the management of the Company, therefore we renominated her as a candidate for Outside Director. |

| Hiroshi Sakuma | Mr. Hiroshi Sakuma has extensive knowledge of energy fields including carbon neutrality, as well as experience leading large organizations, through his work in important positions at Mitsubishi Corporation such as Division COO of New Energy & Power Generation Div. and subsequently Executive Vice President, Group CEO of Global Environmental & Infrastructure Business Group, as well as Member of the Management Board and Chief Cooperation & International Officer of N.V. Eneco*. The Company expects him to oversee the management of the Company as an Outside Director and a management specialist from an independent, objective standpoint, by utilizing those insights and experience. In addition, he has been appropriately fulfilling his duties as an Outside Director of the Company by giving his opinions on management decisions and overall business activities from an investor’s perspective, as well as offering suggestions to the Company’s business operation and overseeing the management of the Company, therefore we renominated him as a candidate for Outside Director.

A comprehensive energy company that engages in business in Europe and that was acquired by Mitsubishi Corporation and Chubu Electric Power Co., Inc. through Diamond Chubu Europe B.V., which was jointly established by them. |

| Noriko Kawakami | Ms. Noriko Kawakami has long engaged in product development in the power electronics field at Tokyo Shibaura Electric Co., Ltd. (currently Toshiba Corporation) and Toshiba Mitsubishi-Electric Industrial Systems Corporation (currently TMEIC Corporation) and possesses extensive knowledge and ample work experience in the energy and digital fields, such as leading the development and commercialization of large-capacity power converters applied to power grids and infrastructure facilities that use renewable energy and so forth. She was awarded the title of fellow from the IEEE* for her contributions to the development and commercialization of this technology. The Company expects her to offer suggestions to the Company’s business operation from a practical perspective and oversee the management of the Company from an independent, objective standpoint as an Outside Director, by utilizing those insights and experience. In addition, she has been appropriately fulfilling her duties as an Outside Director of the Company by giving her opinion in terms of ways to proceed with supply chain development and cost reduction methods and also on intellectual property strategies, as well as offering suggestions to the Company’s business operation and overseeing the management of the Company, therefore we renominated her as a candidate for Outside Director.

The Institute of Electrical and Electronics Engineers, Inc. (IEEE) headquartered in the U.S., the IEEE is the world’s leading association for electrical and electronic engineering technologies. It has over 400,000 members in more than 190 countries around the world. |

| Kengo Miyamoto | Having long engaged in legal practice domestically and internationally as an attorney-at-law, Mr. Kengo Miyamoto possesses a wealth of work experience and specialized knowledge, including providing a wide range of advice to a number of Japanese and international companies in various fields such as manufacturing, service, transportation, and IT. The Company expects him to oversee the management of the Company as an Outside Director from an independent, objective standpoint based mainly on the perspective of compliance, by utilizing those insights and experience. In addition, he has been appropriately fulfilling his duties as an Outside Director of the Company by giving his opinion on matters such as legal strategies and improving the effectiveness of the internal reporting system, as well as offering suggestions to the Company’s business operation and overseeing the management of the Company, therefore we renominated him as a candidate for Outside Director. |

Outside Audit & Supervisory Board Members

| Name | Reasons for appointment |

|---|---|

| Masayoshi Sakaguchi | Mr. Sakaguchi has a wealth of experience in the administrative sector and a proven track record in managing large organizations. He was chief of the Osaka Prefectural Police Headquarters, chief of the Commissioner-General’s Secretariat (National Police Agency), and commissioner-general of the National Police Agency. We have determined he can contribute to improving NGK’s corporate value such as by making use of this experience to express his opinions on the impact of the international situation on business activities, and strengthening our risk management structure as an NGK Outside Audit & Supervisory Board member from the viewpoint of the legality of business and risk management. We have therefore elected him to the position of outside Audit & Supervisory Board member. Mr. Sakaguchi has no personal, financial, or important business relationship with, nor other vested interest in, NGK. He has served as executive advisor to Nippon Life Insurance Company, which is both an NGK shareholder and a source of financing for NGK. However, at the end of FY2024, the Nippon Life Insurance Company's holdings did not exceed more than 1.03% of total NGK shares. Moreover, with regard to the financing received, NGK has business transactions with numerous financial institutions, and the nature of the financing secured from Nippon Life Insurance Company is not such that NGK is in any way beholden to it. Therefore, we deem the shareholding and financial borrowing relationship between NGK and Nippon Life Insurance Company to be one which would not impact NGK’s management decision-making. Moreover, the total amount of NGK payments to Nippon Life of management fees for corporate pension plans is less than 0.1% of consolidated operating expenses and, thus, does not create a conflict of interest with our general shareholders. Concurrent with his work with NGK, Mr. Sakaguchi serves in a variety of roles, including as president of the Japan Automobile Federation. However, no personal, financial, or important business relationship, nor other vested interest, exits between NGK and the organizations with which he currently works. |

| Takashi Kimura | Mr. Kimura possesses many years of experience in managing companies through his service as a Managing Executive Officer at The Bank of Tokyo-Mitsubishi UFJ, Ltd. (now, MUFG Bank, Ltd.), as President and Representative Director of Mitsubishi Research Institute DCS Co., Ltd. In addition to his experience and knowledge in finance and corporate governance gained throughout his career, Mr. Kimura also served as a full-time Audit & Supervisory Board member of MITSUBISHI GAS CHEMICAL COMPANY, INC. and possesses extensive experience and expertise as an auditor of listed companies. We consider him capable of utilizing his broad experience and wide-ranging insight to provide opinions on financial management, governance systems (including those of subsidiaries), and the nature of decision-making to contribute to enhancing the corporate value of NGK, and have therefore elected him as an outside Audit & Supervisory Board member. Mr. Kimura has no personal, financial, or important business relationship with, nor other vested interest in, NGK. Mr. Kimura comes from the Bank of Tokyo-Mitsubishi UFJ (now MUFG Bank), which is both an NGK shareholder and a source of financing for NGK. However, at the end of FY2024, MUFG Bank's holdings did not exceed more than 2.45% of total NGK shares, and, with regard to the financing received, NGK has business transactions with numerous financial institutions, and the nature of the financing secured from MUFG Bank is not such that NGK is in any way beholden to it. Moreover, given that 15 years have already passed since he left the Bank of Tokyo-Mitsubishi UFJ (now MUFG Bank), we do not believe his decisions are affected by the wishes of MUFG Bank in any way that would constitute a conflict of interest with our general shareholders. Also, no personal, financial, or important business relationship, nor other vested interest, exits between NGK and the organizations with which he is or has been involved. |

NGK has submitted written notification to the Tokyo Stock Exchange and Nagoya Stock Exchange of the appointment as independent officers of the above six individuals.

CEO Succession Planning

The revised NGK Group Chief Executive Officer Succession Plan was approved by resolution of the Board of Directors in April 2023. This succession plan establishes the required qualities, development policies, selection procedures, and other actions for developing chief executive officer successors. Based on this, the president provides the Nomination and Compensation Advisory Committee with a progress report on the plan each year, and the committee reviews the appropriateness of the plan.

Matters Related to Compensation

Policy for Determining Compensation

Basic Concept

The compensation system for NGK directors and others has been established for the purpose of contributing to the Group’s sustainable growth and the enhancement of its medium-to-long-term corporate value by practicing the NGK Group Philosophy and realizing the NGK Group Vision. We reassess whether the level and composition of compensation is appropriate in light of those objectives and revise it as appropriate. The Company also strives to ensure transparency and fairness in governance of compensation.

Policies on Determining the Details of Compensation for Directors and Others

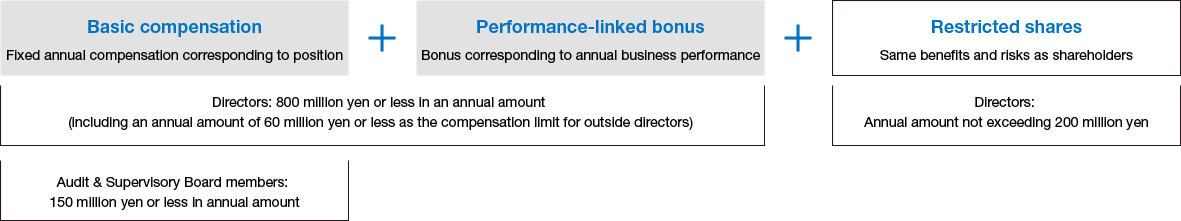

General Meeting of Shareholders Resolutions on Compensation

General Meeting of Shareholders’ resolutions on officer compensation and the details of compensation

| Persons eligible for payment | Date and details of the resolution | Number of persons eligible for payment at the time of resolution | Reference: Type of compensation |

|---|---|---|---|

| Directors | June 28, 2007 Amount of compensation etc.: 800 million yen or less in an annual amount |

14 (including 2 outside directors) | Basic compensation and performance-linked bonuses (excluding outside directors) |

| June 29, 2017 Of the above, the amount of compensation limit for outside directors was revised from 30 million yen or less to 60 million yen or less in annual amount |

13 (including 3 outside directors) | ||

| Directors (excluding outside directors) |

June 27, 2022 Total amount of monetary claims to be paid as compensation for the grant of restricted shares: 200 million yen or less in annual amount |

6 | Restricted share compensation |

| Audit & Supervisory Board Members | June 26, 2023 Amount of compensation etc.: 150 million yen or less in annual amount |

4 | Basic compensation |

Composition of compensation for Directors, Audit & Supervisory Board Members and Executive Officers

Composition Ratio of Compensation for Directors and Audit & Supervisory Board Members in FY2024

| Composition of compensation | Fixed/Variable | Fixed compensation | Variable compensation | ||

|---|---|---|---|---|---|

| Type of incentive | - | Short/Medium-term | Long-term | ||

| Type of compensation | Basic compensation | Performance-linked bonuses | Restricted share compensation* | ||

| Eligible for compensation | Directors | Representative directors | 48% | 38% | 14% |

| Directors (excluding representative directors) | 56% | 28% | 16% | ||

| Outside Directors | 100% | - | - | ||

| Audit & Supervisory Board members | 100% | - | - | ||

Restricted share compensation is a mechanism which assumes that shares will be held long-term until the director steps down, and which is indirectly linked to company performance through stock price.

Items Related to Performance-linked Compensation, etc.

Details of Performance Indicators and Reasons for their Selection Based on Calculation of Performance-linked Compensation Amount

NGK pays its directors (excluding outside directors) and executive officers performance-linked bonuses as performance-linked compensation. These are calculated using the following indicators.

We have adopted the following consolidated performance figures as short-term indicators that emphasize achieving performance goals and annual growth, while taking into account the perspective of capital efficiency.

- Percent change in net sales, operating income, and net income for the current fiscal year compared to the previous fiscal year

- Targets and percent change for return on invested capital (ROIC)* set at the beginning of (or during) the period

Using NGK ROIC (calculated based on operating income, accounts receivable, inventories, and fixed assets).

Moreover, we emphasize medium-term growth, and the degree to which we attain our targets for the following material issues in each fiscal year serves as an indicator of the extent to which we have achieved the NGK Group Vision from the perspective of ESG (Environmental, Social, Governance).

- Percent change in operating income attained for medium- to long-term performance targets in the NGK Group Vision

- Rate of achievement of Keep Up 30* for new products and new business creation

A target of 30% or higher net sales from new products (as defined by NGK)

- Rate of achievement of single-year CO2 emissions reduction targets

Method for Calculating Performance-linked Compensation

We follow the method below to determine the amount of performance-linked bonus paid to each individual.

(a) Set a base bonus amount calculated for each position.

(b) Apportion the base bonus amount among each performance indicator. Allocate a higher percentage to items that take a medium-to- long-term perspective than to those that take a short-term perspective. Then include the representative director's evaluation of the individual performance of each other director and executive officer in the allocation items.

(c) Evaluate each allocation item over a scale of -100% to +100%, and calculate the appraised value for each item.

(d) Sum up these amounts to calculate the amount of performance-linked bonus

As a result, the actual performance-linked bonus paid will vary from -100% to +100% of the base bonus amount.

Percent Allocated per Item for Performance-linked Bonuses and Performance Appraisal Indicators (Excluding Individual Appraisals) and Results for Main Indicators Used to Calculate Performance-linked Bonuses in FY2024

| Item | Percent Allocated | Evaluation Coefficient Variance Ratio | Performance Appraisal Indicators (Calculated in practice by replacing each indicator with the variance ratio and evaluating it.) |

|---|---|---|---|

| Short-term Indicators |

40% | -100% to +100% |

Consolidated results (net sales / operating income / net income)

|

| -100% to +100% |

Return on invested capital

|

||

| Medium- to long-term Indicators |

60% | -100% to +100% |

Medium- to long-term performance targets (operating income)

|

| -100% to +100% |

Rate of achievement of material issues (important items listed below)

|

Non-monetary Compensation etc.

Restricted Shares Compensation

NGK grants restricted share compensation to directors (excluding outside directors) and executive officers (excluding executive officers who are overseas residents on a non-temporary basis) in order to increase their sensitivity to stock price, to further share with shareholders the benefits and risks associated with stock price fluctuations, and to motivate them to improve corporate value over the medium to long-term. Since stock price fluctuations are directly related to its value, the amount of restricted shares is not fixed, but the number of shares granted is fixed in accordance with the position.

The following is an overview of the restricted share compensation we granted in FY2024.

| Overview of restricted share compensation | |

|---|---|

| Class and number of shares to be issued | NGK common stock: 126,500 shares |

| Issue price | 2,082 yen per share |

| Aggregate issue amount | 263,373,000 yen |

| Persons eligible for the allotment of the shares and the number thereof, as well as the number of shares to be allotted | NGK directors (excluding outside directors): 6 people, 45,500 shares executive officers who do not concurrently serve as NGK directors: 24 people, 81,000 shares (excluding executive officers who are overseas residents on a non-temporary basis) |

Period of the transfer restriction stipulated in the restricted share allotment agreement (hereinafter “the Allotment Agreement”):

The allottees must not transfer, establish as security interests or otherwise dispose of NGK’s ordinary shares allotted to them according to the Allotment Agreement from the date on which they receive their allotment according to the Allotment Agreement to the point in time directly after retiring from the position determined in advance by NGK’s Board of Directors from among the positions of NGK’s officers and employees.

Claw Back Clause

NGK has a provision to acquire all of the accumulated allotted stocks without compensation in the event that the allottee of the restricted shares violates laws and regulations during the period of the transfer restriction, or in the event that certain other conditions stipulated in the allotment agreement are met.

Stock Holding Guideline for Directors and Executive Officers

In order to foster a sense of shared value between directors and executive officers and shareholders, and to contribute to the sustainable growth of the NGK Group and the enhancement of its corporate value over the medium to long-term, NGK has established guidelines for holding its own stock, etc.*1 and in principle, within three years of assuming office, directors and executive officers shall endeavor to hold company stock, etc. equivalent to the following values.

1 Includes stock compensation-type stock options that have not yet reached the exercise commencement date.

| Persons eligible | |

|---|---|

| Directors (Chairman and President) | 150% or more of basic compensation (annual amount) |

| Directors*2 and Executive Officers*3 | 100% or more of basic compensation (annual amount) |

2 Excluding Chairman, President, and outside directors

3 Excluding executive officers who are overseas residents on a non-temporary basis

Amount of Compensation for Directors and Audit & Supervisory Board Members

Total Compensation for Directors and Auditor & Supervisory Board Members (FY2024)

| Director category | Total compensation (million yen) |

Total compensation by type (million yen) |

Applicable officers (people) |

||

|---|---|---|---|---|---|

| Fixed Compensation | Performance-linked compensation | Restricted share compensation | |||

| Directors (excluding Outside Directors) |

610 | 303 | 217 | 89 | 7 |

| Outside Directors | 53 | 53 | ‒ | ‒ | 6 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

72 | 72 | ‒ | ‒ | 2 |

| Outside Audit & Supervisory Board Member | 28 | 28 | ‒ | ‒ | 2 |

Notes:

- 1. The total amount of compensation for directors (excluding outside directors), the total amount of compensation by type, and the number of directors receiving compensation as noted above, includes one director who resigned from their position on June 26, 2024 and the amount of compensation they received.

- 2. The total amount of compensation for outside directors, the total amount of compensation by type, and the number of directors receiving compensation as noted above, includes two outside directors who resigned from their positions on June 26, 2024 and the amount of compensation they received.

Compensation of Directors Receiving Total Compensation of ¥100 Million or More (FY2024)

| Name | Officers category | Company category | Total compensation by type (million yen) | Total compensation (million yen) | ||

|---|---|---|---|---|---|---|

| Fixed compensation | Performance-linked compensation | Restricted share compensation | ||||

| Taku Oshima | Director | Submitting company | 67 | 54 | 19 | 141 |

| Shigeru Kobayashi | Director | Submitting company | 67 | 52 | 19 | 140 |

Average Employee Compensation and President Compensation

The compensation of the Representative Director and President in FY2024 was 16.6 times the average compensation of employees at NGK.

(FY2024)

Compensation of Representative Director and President: 140,000,000 yen

Average Compensation of Employees: 8,453,574 yen