Sustainability

Corporate Governance System

Basic Approach

NGK Group’s basic policy on corporate governance is to ensure legality in business activities and transparency in management. NGK Group has established a structure that can respond swiftly to changes in the business environment and built and maintains shareholder-focused system to ensure fair management.

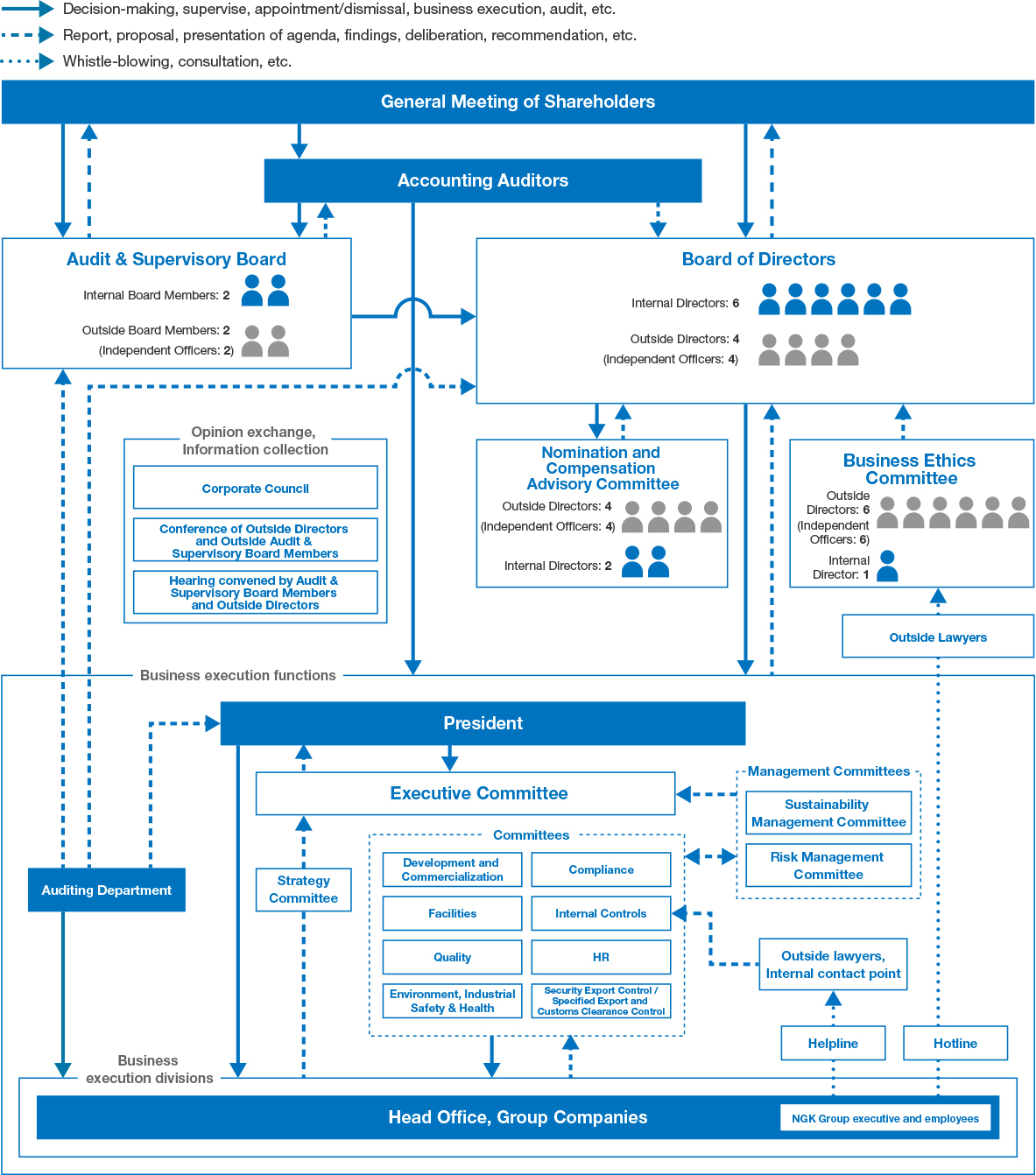

To put this policy into practice, NGK has chosen the governance structure of a company with an Audit & Supervisory Board. We have established a corporate governance system that increases the effectiveness of corporate governance through debate and deliberation on important matters. This was accomplished by establishing the Executive Committee, Sustainability Management Committee, Risk Management Committee and various other committees to support the president in making decisions, in addition to the General Meeting of Shareholders, Board of Directors, and Audit & Supervisory Board.

NGK recognizes the need for swift, optimal decision-making and execution to respond to changes in the business environment. We have therefore introduced an executive officer system to segregate the management decision-making and supervisory function from the business execution function to clearly define the roles of and strengthen each function.

To strengthen the supervisory and oversight function of the Board of Directors, we have mandated reporting to Board of Directors from the key committees among committees that handle various risks surrounding NGK. To ensure that the objectives of the Corporate Governance Code are thoroughly implemented, we established the Nomination and Compensation Advisory Committee, Corporate Council, Conference of Outside Directors and Outside Audit & Supervisory Board Members, the Business Ethics Committee, and other committees.

In addition, we have established the NGK Group Corporate Business Principles and NGK Group Code of Conduct to stipulate how everyone working for the NGK Group should execute their jobs so that they abide by society’s laws and NGK Group’s Articles of Incorporation and comply with corporate ethics. All executives and employees are well versed in the code and are obligated to abide by it.

Internal Control Systems

The NGK Board of Directors has established the following systems to ensure that directors comply with laws and regulations and NGK’s Articles of Incorporation in the execution of their duties. This includes the systems deemed necessary to ensure the appropriateness of NGK’s business operations as well as the operations of the NGK Group consisting of NGK and its subsidiaries. The business execution organizational bodies that report to the president are responsible for operating these systems.

Basic Views on Internal Controls System and Status of Development

Steps Taken to Strengthen Corporate Governance

We continue to strengthen the corporate governance system. Enhancements include introducing an executive officer system to improve the management supervision and monitoring functions and other functions, and to provide suggestions on all aspects of management.

| April 1999 | Established the NGK Corporate Business Principles |

|---|---|

| April 2003 | Revised guidelines into the NGK Group Corporate Business Principles |

| June 2005 | Introduced an executive officer system |

| Introduced a stock option | |

| Introduced an outside officer system | |

| July 2005 | Established the CSR Committee |

| June 2010 | Appointed independent officers |

| July 2011 | Revised the NGK Group Corporate Business Principles |

| April 2015 | Signed on to the UN Global Compact |

| June 2015 | Established the Global Compliance Office |

| December 2015 | Established the Nomination and Compensation Advisory Committee, Corporate Council, Conference of Outside Directors and Outside Audit & Supervisory Board Members, and Business Ethics Committee |

| June 2017 | Appointed one additional outside director |

| October 2018 | Appointed a Chief Compliance Officer |

| January 2019 | Revised the NGK Group Corporate Business Principles |

| April 2019 | Established the ESG Committee |

|---|---|

| April 2020 | Established the Compliance Committee |

| Established the HR Committee | |

| April 2021 | Formulated the NGK Group Vision |

| Formulated the NGK Group Human Rights Policy | |

| Established the NGK Group Basic Guidelines for Compliance Activities | |

| June 2021 | Outside directors increased to 1/3rd of Board of Directors |

| An outside director made the chair of the Nomination and Compensation Advisory Committee | |

| April 2022 | Established the ESG Management Committee |

| June 2022 | Introduced a Restricted Share Compensation Plan |

| April 2023 | Established the Risk Management Committee |

| Formulated the NGK Group Basic Sustainability Policy | |

| July 2023 | Revised the NGK Group Corporate Business Principles Established the NGK Group Code of Conduct |

| June 2024 | Increased ratio of female directors to 30% |

| April 2025 | The ESG Management Committee was renamed the Sustainability Management Committee |

Corporate Governance System

We have established the following system to ensure legality in business activities and transparency in management. This system makes it possible to respond swiftly to changes in the business environment and maintains a shareholder-focused system to ensure fair management.

Corporate Governance Organizational Chart