Sustainability

State of Each Organization

Board of Directors

Composition of Board of Directors (As of September, 2025)

Director Attributes and Committee Membership (as of September, 2025)

| Name | Age | Stocks held etc. | Meeting attendance record | |||

|---|---|---|---|---|---|---|

| Number of shares of the Company held | Number of stock acquisition rights owned (Equivalent number of shares) | Board of Directors | Nomination and Compensation Advisory Committee | Business Ethics Committee | ||

| Taku Oshima | 68 | 40,000 | 66,000 | ◎ 100% (16/16) |

100% (3/3) |

|

| Shigeru Kobayashi | 64 | 40,126 | 21,000 | 100% (16/16) |

100% (3/3) |

|

| Hideaki Shindo | 60 | 19,500 | 10,000 | 100% (16/16) |

||

| Jun Mori | 61 | 16,090 | 8,000 | - | ||

| Mayumi Inagaki | 61 | 13,741 | 5,000 | 100% (12/12)* |

100% (4/4)* |

|

| Emiko Hamada | 66 | 5,000 | - | 100% (16/16) |

◎ 100% (3/3) |

◎ 100% (5/5) |

| Hiroshi Sakuma | 69 | - | - | 100% (12/12)* |

100% (3/3) |

100% (4/4)* |

| Noriko Kawakami | 66 | 3,000 | - | 100% (12/12)* |

100% (3/3) |

100% (4/4)* |

| Kengo Miyamoto | 57 | 3,000 | - | 100% (12/12)* |

100% (3/3) |

100% (4/4)* |

Notes:

- 1. ◎ indicates chair or committee chair

- 2. Meeting attendance shown is for FY2024

Applies to meetings of the Board of Directors and Business Ethics Committee held after they assumed office on June 26, 2024

Ratio of Independent Outside Directors

| Target ratio of Independent Outside Directors | Result | Name |

|---|---|---|

| One-third of the Board of Directors | 1/3 or more | Emiko Hamada, Hiroshi Sakuma, Noriko Kawakami, Kengo Miyamoto |

Ratio of Female Directors

| Target ratio of female Directors | Result | Name |

|---|---|---|

| 30% of Directors | 33% | Mayumi Inagaki, Emiko Hamada, Noriko Kawakami |

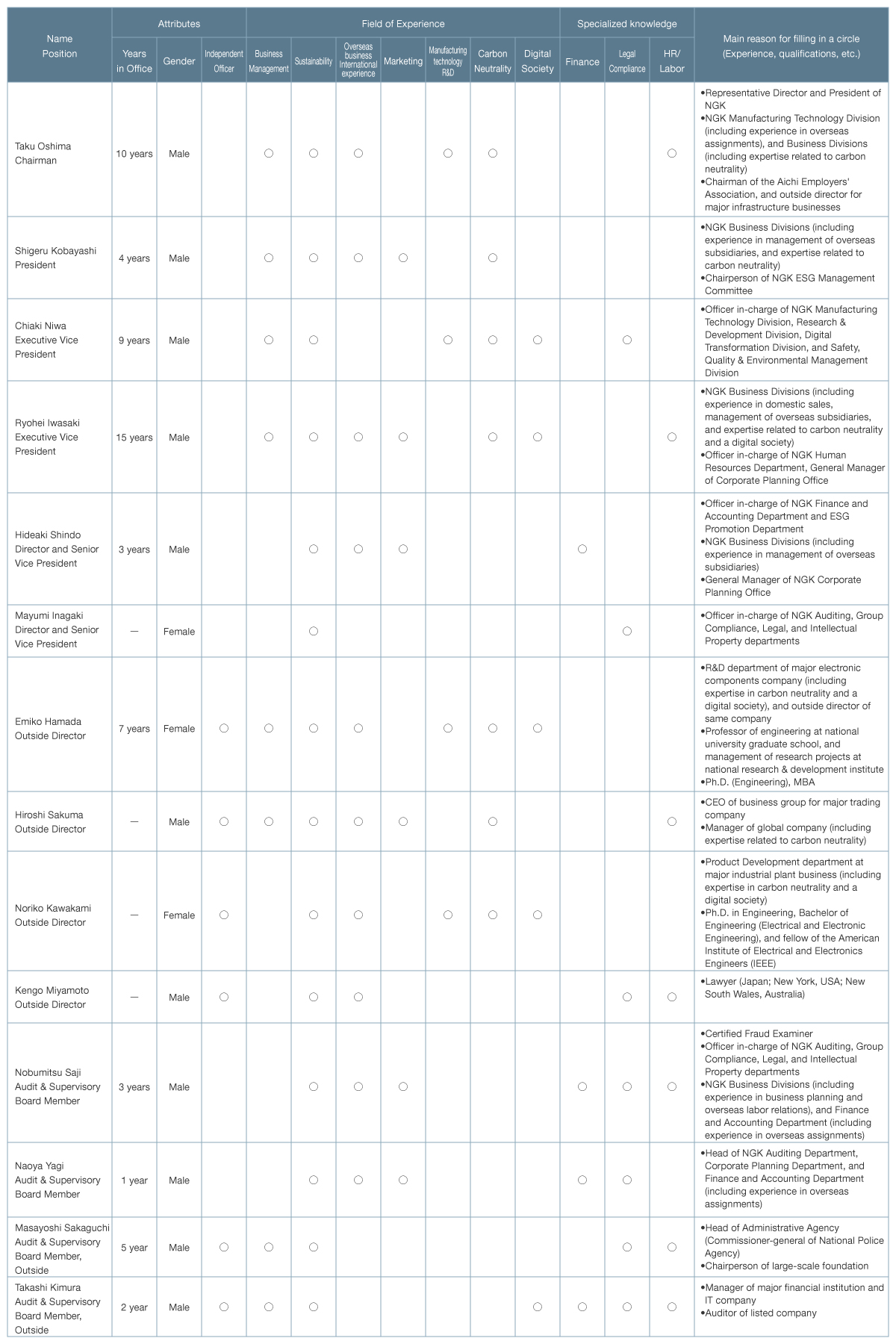

Director/Audit and Supervisory Board Member Skill Matrix and Reasons for Item Selection

Director/Audit and Supervisory Board Member Skill Matrix and Reasons for Item Selection

Reasons for selection as field of experience/specialized knowledge

| Corporate management | We believe that experience in and knowledge about corporate management in particular are essential to ensure legality in business activities and transparency in management, as well as promote healthy risk-taking and effectively supervise appropriate decisionmaking and business execution. |

|---|---|

| Sustainability | Our management is centered on ESG (Environmental, Social, Governance) to realize the NGK Group Vision. We believe that experience and knowledge in the sustainability field in particular are essential to correctly recognize the ESG factors and other sustainability issues of the NGK Group and to connect these to the enhancement of our medium- to long-term corporate value by appropriately supervising and addressing initiatives aimed at sustainability issues. |

| Overseas business/ International experience |

We believe that experience in overseas business or other international experience in particular are essential to provide appropriate advice and effectively supervise business execution in the business of the NGK Group supplying materials such as ceramics and related products to a wide range of areas including overseas. |

| Marketing | Reinforcing societal implementation of our technologies and thereby commercializing products are indispensable for the realization of the NGK Group Vision. We believe that experience and knowledge gained through work including marketing in the sales or planning field in particular are essential to provide appropriate advice to the above activities and effectively supervise business execution. |

| Manufacturing technology R&D |

Creating new businesses early and encouraging innovation in production processes are indispensable for the achievement of New Value 1000 (aiming to attain 100.0 billion yen of sales in newly launched businesses in 2030) laid out in the NGK Group Vision. We believe that experience and knowledge in the manufacturing technology or R&D field in particular are essential to provide appropriate advice to the above activities and effectively supervise business execution. |

| Carbon neutrality | We have formulated the NGK Group Environmental Vision, aiming to build a main business in the field related to carbon neutrality (CN) through the transformation of our business structure, which is set forth in the NGK Group Vision, and aiming to contribute to the realization of “CN,” a “recycling-oriented society,” and “harmony with nature,” which are required by society, through our business activities. We believe that experience and knowledge regarding carbon neutrality in particular are essential to provide appropriate advice to, manage, and effectively supervise business strategies for achieving these objectives. |

| Digital | We have formulated the NGK Group Digital Vision, aiming to build a main business in the field related to digital society (DS) through the transformation of our business structure, which is set forth in the NGK Group Vision, and aiming to become a company where the use of data and digital technology will be commonplace in 2030, by positioning digital transformation (DX) as the driving force for our business transformation and accelerating DX throughout the NGK Group. We believe that experience and knowledge regarding digital technology in particular are essential to provide appropriate advice to, manage, and effectively supervise business strategies for achieving these objectives. |

| Finance | The NGK Group will strive to enhance its enterprise value by accelerating the transformation of its business portfolio through the proper allocation of management resources as well as promoting three initiatives: enhanced profitability of capital, secured growth, and the enhancement of non-financial value. We believe that specialized knowledge in finance in particular is essential to provide appropriate advice to, manage, and effectively supervise financial strategies for promoting and achieving these objectives. |

| Legal compliance |

We have established the NGK Group Corporate Business Principles and NGK Group Code of Conduct to stipulate how everyone working for the NGK Group should execute their jobs so that they abide by society’s laws and the Company’s Articles of Incorporation and comply with corporate ethics. It is the Board of Directors’ responsibility to ensure appropriate management by monitoring the status of compliance with these laws and ethics. The Board of Directors is also required to identify a number of risks that can occur in daily business activities and appropriately manage such risks. Therefore, we believe that specialized knowledge in legal compliance in particular is essential. |

| HR/Labor | The NGK Group aims to add new value to society by developing an enriched and lively workplace environment where personnel with diverse experiences and values can play active roles, and each personnel autonomously embraces challenges and elevate each other. In addition, we have established the NGK Group Human Rights Policy to ensure that the human rights of all people affected by the NGK Group’s business activities will not be violated, promoting initiatives for respect for human rights. We believe that specialized knowledge regarding human resources and labor in particular is essential to provide appropriate advice to, manage, and effectively supervise human resources strategies for promoting and achieving these objectives. |

Nomination and Compensation for Directors and Audit & Supervisory Board Members

Board of Directors Diversity Policy

The Articles of Incorporation specify a maximum of 15 directors on the NGK Board of Directors. NGK does not discriminate on the basis of gender, age, nationality, and race. Based on this policy, NGK strives to enhance diversity in both gender and internationality of the Board of Directors by electing women directors and directors who possess experience in the management of overseas subsidiaries. NGK also strives to ensure the independence of the Board of Directors by specifying that one-third or more of directors be independent outside directors.

NGK deems the following director skills necessary: Practical experience and demonstration of leadership in areas in which the NGK Group operates its business; professional expertise in finance, legal affairs, human resources and labor, information and communications, and other areas. We also think it is necessary to have highly independent outside directors who possess a high degree of expertise in legal affairs or corporate finance, or who possess knowledge of international affairs, trends in technology, and corporate management. The skill matrix (expertise) of the current Board of Directors is shown above.

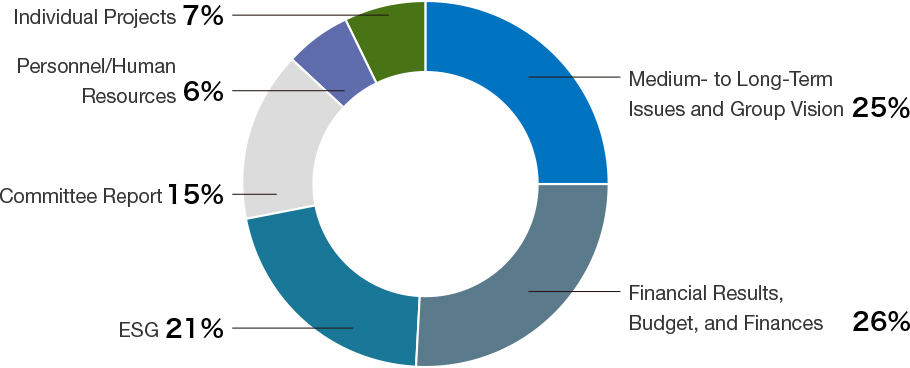

Activities of Board of Directors

Number of members: 9; Convened 16 times in FY2024

The Board of Directors is composed of nine directors (six males, three females; one-third or more of directors are outside directors). It discusses and votes on matters designated under the Companies Act, NGK’s Articles of Incorporation and Rules for the Board of Directors (These matters include company-wide unified budgeting, strategic planning such as dissolution, mergers, and alliances of the company, appointing and dismissing representative directors, and authorizing business reports and financial statements etc., the disposal and acceptance of transfer of important assets, the appointment and removal of important employees, etc.). The Board also monitors the job performance of all company directors. The chair of the Board of Directors is a non-executive director. In addition, both the full-time and outside members of the Audit & Supervisory Board attend meetings of the Board of Directors and provide their opinions when necessary.

The key topics and time allocated for each category in FY2024 were as follows.

[Medium- to Long-Term Issues and Group Vision]

- Formulation of materiality action plans and KPI

- Initiatives for new business creation (Progress report on New Value 1000)

- Initiatives concerning business portfolio

- Determining key risks to follow-up on

[Financial Results, Budget, and Finances]

- Budget and financial results

- Sale of long-term shareholdings

- IR/SR activities report

[Environmental, Social, Governance (ESG)]

- Progress report on fifth 5-Year Environmental Action Plan

- Information disclosure based on TNFD

- Formulation of competition laws compliance program

- Renewable electricity procurement

[Committee Report]

- Report on principal committee activities

[Personnel/Human Resources]

- Organization and Personnel

- Deployment of senior management

- Revision of human resources system for key personnel

[Individual Projects]

- Investment in production facilities, R&D, etc.

- Change to trade name

Time Allocated to Key Topics

Audit & Supervisory Board / Audits

Composition of the Audit & Supervisory Board (As of June 30, 2025)

| Name | Age | Number of shares of the Company held |

Number of stock acquisition rights owned (Equivalent number of shares) |

Board of Directors | Audit & Supervisory Board meeting | Nomination and Compensation Advisory Committee |

Business Ethics Committee |

|---|---|---|---|---|---|---|---|

| Naoya Yagi | 60 | 4,306 | - | 100% (16/16) |

◎ 100% (13/13) |

- | - |

| Koji Hasegawa | 61 | 1,040 | - | - | - | - | - |

| Masayoshi Sakaguchi | 67 | - | - | 100% (16/16) |

100% (13/13) |

◇ 100% (3/3) |

100% (5/5) |

| Takashi Kimura | 70 | - | - | 100% (16/16) |

100% (13/13) |

- | 100% (5/5) |

Notes:

- 1. ◎ indicates the chair

- 2. ◇ indicates attendance as an observer

- 3. Meeting attendance shown is for FY2024

Audit Policy and Audit Plan

At the beginning of each fiscal year, the Audit & Supervisory Board formulates an audit policy and audit plan, and sets key audit items. For FY2025, these are as follows.

[Audit Policy]

The Audit & Supervisory Board and each of its members focus on monitoring management risks to ensure that NGK's internal control systems function properly in light of the business environment and other conditions, and that the entire group can be maintained in good health. This includes checking our crisis management systems for handling natural disasters as well as various other risk cases. We believe that it is vital to check on the progress and permeation of the NGK Group Vision both inside and outside the company.

We base our audits on managing risks during the execution of day-to-day business and confirming the rationality of management decisions. Where necessary, we conduct investigations into individual matters, and work to improve governance.

[Important Audit Items]

(1) NGK Group Vision

- The status of ESG-related initiative penetration

- The progress of new business, business restructuring, etc.

- Business-specific risk awareness and reasonableness of the management decision-making process

(2) Confirm framework for handling risk management and readiness to face future changes

Status of Audits by Audit & Supervisory Board Members

Number of members: 4; Convened 13 times in FY2024

The Audit & Supervisory Board is composed of four Audit & Supervisory Board members (all male). Audit & Supervisory Board members supervise directors’ decision-making process and job performance, by attending meetings of the Board of Directors and other important meetings, receiving reports from directors, employees, etc. and requesting explanations where necessary. In addition, they review the establishment and operation of so-called internal control systems, and confirm the appropriateness of accounting auditors’ auditing methods and results.

The major resolutions and matters reported in FY2024 were as follows.

[Resolutions]

- Audit & Supervisory Board members' audit policy and audit plans, and audit reports of the Audit & Supervisory Board

- Consent to compensation for Audit & Supervisory Board members

- Confirmation of proposals and documents to be submitted to the General Meeting of Shareholders

- Formulation of criteria for Audit & Supervisory Board member candidates

- Consent to the comprehensive advance agreement for non-assured engagement that was provided by the auditing firm to which the accounting auditors belong, as well as its network firm

[Reports]

- Report on audit activities by full-time Audit & Supervisory Board members

- Audit plan by the Accounting Auditor

- Financial audit report by the Accounting Auditor

- Report on Financial Results by the Finance & Accounting Department

- Report on the results of internal audits by the Auditing Department

- Confirmation of the Convocation notice of the annual shareholder’s meeting

Internal Audits

The Internal Auditing Department has established an Auditing Department (20 members: as of March 31, 2025), and the general manager of the Auditing Department is a member of the Internal Control Committee. The Auditing Department audits the status of business execution in NGK and each domestic and overseas Group company based on audit plans approved by resolution of the Board of Directors, and reports the results of audits to the President, Board of Directors, and Audit & Supervisory Board.

While internal audits are conducted independently of Audit & Supervisory Board audits and accounting audits, the Auditing Department regularly discusses audit policy, plans, and results with Audit & Supervisory Board members and the accounting auditor to improve the effectiveness and efficiency of audits. It also compiles the results of individual audits and reports them to the President and Audit & Supervisory Board members whenever necessary. Moreover, because audits in areas such as quality, environment, and safety and health require specialized knowledge, the dedicated departments serving as secretariats of the committees involved with each area perform internal group audits. They report the results of these audits within each committee and report the committee summaries to the Board of Directors.

Accounting Audits

Accounting audits are performed by an auditing firm and include financial statement and internal control auditing carried out in line with the Financial Instruments and Exchange Act and auditing carried out in line with the Companies Act.

Selection of the auditing firm to perform accounting audits was carried out by the Audit & Supervisory Board according to a variety of criteria. Among the key criteria were whether the firm maintains systems and structures in line with the Regulation on Corporate Accounting (“Matters Related to the Performance of Duties of Financial Auditor(s)”); whether it possesses professional expertise and can carry out appropriate auditing while maintaining a position of independence; and whether there are any grounds for dismissal of financial auditors, as per the Companies Act. Based on the results of this confirmation, NGK selected Deloitte Touche Tohmatsu LLC as the current accounting auditor.

In addition to the above criteria for the selection of the accounting auditor, Audit & Supervisory Board members and Audit & Supervisory Board also evaluated the suitability of the accounting auditor from the perspective of whether it communicates with management, Audit & Supervisory Board members, the Finance Department, and Internal Auditing Department, performs Groupwide audits, and addresses risk of fraud appropriately, through the daily audit activities. Based on this, Deloitte Touche Tohmatsu LLC (“Deloitte”) has been determined to be qualified to serve as the accounting auditor for NGK.

Board of Directors Audit Advisory Committee

Nomination and Compensation Advisory Committee

Number of members: 6; Convened 3 times in FY2024

The Nomination and Compensation Advisory Committee was established in order to ensure fairness and enhance transparency in officers' personnel matters, the determination of compensation, and other matters as an advisory body to the Board of Directors. The committee receives inquiries from the Board of Directors and then deliberates on personnel matters for directors and the Audit & Supervisory Board members (including handling by the Chief Executive Officer during states of emergency), matters relating to compensation for directors and executive officers, upper limits on the total compensation amount for directors and Audit & Supervisory Board members, and a succession plan for the Chief Executive Officer (formulation and revision of succession plan, progress on developing potential successors, and determination of successor candidates), etc. The committee reports its results to the Board of Directors. The committee (4 male members and 2 female members) consists of a majority of independent outside directors and a committee chairperson who is selected from among the independent outside directors. The chair and members are selected by the Board of Directors. In addition, one outside Audit & Supervisory Board member attends committee meetings as an observer to confirm the appropriateness of the deliberation process.

The major matters discussed by the committee in FY2024 were as follows.

- Appointment of directors, representative directors, directors in key positions, and Audit & Supervisory Board members

- Compensation (cash and stock-related compensation) commensurate with the position of each individual director and executive officer

- Amount of performance-linked bonuses paid to each individual director this fiscal year

- Progress on development of successors to the Chief Executive Officer

Other Various Types of Meeting Bodies

Business Ethics Committee

Number of members: 7; Convened 5 times in FY2024

The Business Ethics Committee is comprised of outside officers and internal directors who are in charge of compliance (4 male and 3 female). The committee conducts necessary investigations into fraudulent acts and violations of laws and regulations involving corporate officers and employees and advises the Board of Directors on how to prevent recurrence. To ensure compliance with competition laws and the Foreign Corrupt Practices Act, the committee works on building a compliance system and considering compliance activities, and makes recommendations to the Board of Directors. The Committee strives to strengthen the compliance system by establishing, in addition to the current Helpline System, a whistle-blowing system (hotline), which is directly linked to the Business Ethics Committee, as a mechanism to prevent any such fraudulent act or violation of laws and regulations.

Corporate Council

Number of members: 11; Convened 2 times in FY2024

The Corporate Council is a council where outside officers and internal directors, and others can exchange opinions. It provides an opportunity for management to actively seek advice from outside officers on various issues concerning management. The council is composed of eight male members and three female members.

Conference of Outside Directors and Outside Audit & Supervisory Board Members

Number of members: 6; Convened 2 times in FY2024

This conference consists only of outside officers and is a conference where outside officers can exchange opinions concerning corporate management issues and other matters to actively contribute to discussions in Board of Directors meetings. The committee is composed of four male members and two female members.

Hearing Convened by Audit & Supervisory Board Members and Outside Directors

Number of members: 8; Convened 14 times in FY2024

Hearings consist of Audit & Supervisory Board members and outside directors. The purpose of these hearings is to collect information from relevant internal personnel concerning the corporate business environment and company issues. The hearing is composed of six male members and two female members.

Business Execution System

Executive Committee

Number of members: 16; Convened 23 times in FY2024

The Executive Committee is the body that deliberates necessary matters to assist the president in making decisions. It consists of the president, executive vice presidents, group executives of each business group, the group executive of Corporate NV Creation, the group executive of Corporate R&D, the group executive of Corporate Manufacturing Engineering, directors in charge of each department, and full-time Audit & Supervisory Board members, as well as corporate officers, committee chairs, general managers and division heads designated by the president. Fifteen committee members are male and one is female.

Other Bodies *The number of times held refers to the cumulative total from April 2024 to March 2025

| Strategy Committee Convened: 16 times |

This committee conducts a broad range of discussions aimed at discovering problems and considering solutions concerning issues important to business management, strategy and policy planning, and reporting on the execution status and progress of various businesses and projects. |

|---|---|

| Sustainability Management Committee Convened: 6 times |

This body assists the president, who is the Sustainability Management Committee chairperson, in decision-making about strategy, action plans, and important issues related to NGK Group sustainability (medium-to-long-term), as well as Environmental, Social, and Governance, and Sustainable Development Goals. It also performs deliberation for the presentation of agenda items deemed important to the Board of Directors or the Executive Committee. Note: In April 2022, we renamed the former “ESG Committee” to the “ESG Management Committee.” The Committee will more proactively address the NGK Group’s sustainability issues and the activities will be appropriately supervised by the Board of Directors. |

| Risk Management Committee Convened: 3 times |

This is a body established to report important matters relating to risk management to the Board of Directors and Executive Committee, to assist the Board of Directors in supervising the Group’s risk management, and to contribute to increasing the sophistication of risk management. |

| Development and Commercialization Committee Convened: 4 times |

This body deliberates items necessary to assist the decision-making of the president and Development and Commercialization Committee chair regarding policies, evaluations, budgets, major individual planning, and commercialization projects related to development and commercialization. |

| Capital Investments Committee Convened: 10 times (Not including joint meetings with the Development and Commercialization Committee) |

This body deliberates items necessary to assist the decision-making of the president and Capital Investments Committee chair regarding the examination and evaluation of policies, budgets, performance, and major individual planning related to capital expenditure and information systems. |

| Quality Committee Convened: 2 times (Not including joint meetings with the Development and Commercialization Committee) |

Aiming to increase customer satisfaction and trust by realizing even higher-quality products and services, this body deliberates the matters necessary to help the president and the Quality Committee chair with decision-making regarding the following items.

|

| Safety and Health Committee Convened: 2 times |

This body performs overall management of the environment, safety and health for the NGK Group by regularly ascertaining overall conditions, and carrying out the necessary deliberations for making decisions on important policies, formulating action plans, and handling important matters. |

| Compliance Committee Convened: 3 times |

This body assists the president and Compliance Committee chair with decision-making by deliberating essential matters pertaining to the following.

|

| Internal Controls Committee Convened: 3 times |

This body deliberates matters necessary to help the president and Internal Controls Committee chair with decision-making regarding internal controls system assessment and reporting related to financial reporting based on the Financial Instruments and Exchange Act.

|

| HR Committee Convened: 7 times |

This body assists the president with decision-making by examining issue presentation, research reporting, solution development, and other essential matters related to corporate obligations in respecting human rights (issue handling) and the important personnel policies within the NGK Group.

|

| BCP Countermeasures Headquarters Convened: 1 time |

Aimed at ensuring business continuity in critical situations such as disasters, terrorism, or systems failure, this body executes the operation and maintenance of business continuity plans (BCP) in normal times as well as gives instructions on and support to restoration systems, and prioritizes restoration orders when BCP is in effect. |

| Central Disaster Prevention and Control Headquarters Convened: 1 time |

This body executes requisite duties under commands from the Head and deliberates items necessary to assist the decision-making of the president and Head of this body regarding items related to earthquakes, storm and flood damage, fires, and explosions that threaten or significantly impact the company. |

| Security Export Control / Specified Export and Customs Clearance Control Committee Convened: 1 time |

This body deliberates and determines items necessary for guidance for subsidiaries and affiliates, legal compliance and the improvement of other internal systems with respect to security export controls, specified export declaration systems, and the management of customs clearance operations. |

Effectiveness of Board of Directors

Evaluation on the effectiveness of the Board of Directors

Analysis and Evaluation Results concerning the Effectiveness of Board of Directors

NGK’s Board of Directors conducts a survey of directors and Audit & Supervisory Board members at the close of each fiscal year on the effectiveness of Board of Directors meetings. The Board entrusts analysis and evaluation of the responses to an external organization, which reports the results to the Board of Directors. NGK continually strives to improve effectiveness through such means as considering the importance and necessity of each issue identified and reinforcing efforts in Board of Directors meetings during the next fiscal year.

1. Policy on Initiatives and Main Initiatives for FY2024, Based on the Effectiveness Evaluation Covering FY2023

- Board of Directors policy on initiatives

- The following items should continue to be monitored and regularly reported to the Board of Directors in order to achieve the NGK Group Vision

- Status of the business portfolio revision

- Progress of the New Value 1000 (aiming for sales of 100 billion yen from new commercialized products by 2030)

- Progress of various committee activities and company-wide projects

- Progress of human resources strategy

- Status of company-wide risk management

- IR and SR activities

[Primary Initiatives]

We also established multiple reporting periods for each of the annual agenda items above, and reported to the Board of Directors. Concerning our human resources strategy, above all, we discussed the ideal form of personnel system for key personnel (managers) and resolved to revise our Key Personnel System in order to promote maximum utilization of and autonomous action by diverse personnel.

- Identify issues that should be given priority for discussion, and deepen discussion of long-term management plans and business strategies (including group companies)

[Primary Initiatives]

Continuing from FY2023, the energy storage business, and Group subsidiary strategy were discussed intensively at the expansion strategy meeting, which was held twice and also attended by outside officers. - Work to enhance opportunities for dialogue between senior management and outside officers, while deepening discussions on succession plans and training senior management

[Primary Initiatives]

Lunch meetings between senior management and outside officers were held once a month with participants sitting wherever they liked. We also promoted more vigorous and substantial exchange of opinions by setting up interviews between outside directors and executive officers. Meanwhile, senior management attended hearings convened by Audit & Supervisory Board members and outside directors, and reported on the general state of the business. - Strive to further enhance provision of information to outside officers

[Primary Initiatives]

Concerning items on the agenda for the Board of Directors, we strove to further enhance opportunities for individual explanations according to department in charge, etc. At the same time, we put in place a framework that provides outside officers with constant access to materials related to the execution of business and used by the Executive Committee, Strategy Committee, and various other committees.

- The following items should continue to be monitored and regularly reported to the Board of Directors in order to achieve the NGK Group Vision

- Policy on initiatives for the Nomination and Compensation Advisory Committee

- Continue striving to further share the state of committee discussions with the Board of Directors

[Primary Initiatives]

The state and content of committee discussions were carefully shared with the Board of Directors using committee materials. In addition, intentions regarding the deployment of senior management were reported to the Board of Directors by the President when decisions were made concerning the organization or personnel. - Continue striving to further enhance provision of information to the Nomination and Compensation Advisory Committee

[Primary Initiatives]

More detailed data about the personal history, skills, and expected roles of new directorial candidates and Audit & Supervisory Board members was provided to each committee member by the committee secretariat.

- Continue striving to further share the state of committee discussions with the Board of Directors

2-1. Methods of Effectiveness Evaluation for FY2024

- A survey comprising a total of 30 questions, 6 questions evaluating the initiatives for FY2024, and two free-response entries was conducted on all directors (10 members) and all Audit & Supervisory Board members (4 members) at the beginning of April 2025, and the analysis and evaluation of the responses were entrusted to an external organization.

The survey questions are also periodically reviewed in light of changes to the current environment. - In addition, as part of the effectiveness evaluation of the Board of Directors, the Nomination and Compensation Advisory Committee has conducted a questionnaire to its members (chairperson, members, and observers), and entrusted the analysis and evaluation of the responses to an external organization.

2-2. Summary of Evaluation Results for FY2024

- A summary of the evaluation results was reported to the Board of Directors at its meeting on June 6, 2025.

- Based on the results of the questionnaire, the external evaluation of the effectiveness of the Board of Directors (including the Nomination and Compensation Advisory Committee) was high overall, and stated that the Board of Directors is operating appropriately.

- Overall comments from external organizations are as follows.

- The NGK Board of Directors has an appropriate member composition and suitably comprises elements that form the foundation necessary as a Board of Directors, including the commitment of each member and a healthy culture. These have been maintained as strengths based on the results of the past few years.

- The Nomination and Compensation Advisory Committee conducts practical discussions and evaluates whether it has properly shared the details of these with the Board of Directors.

- The policies for initiatives in FY2024 were drawn up based on the results of the effectiveness evaluation for the previous fiscal year. In response, they set up opportunities for discussion about business strategy, expanded the information shared with outside directors, and strove to broaden the content of reports from the Nomination and Compensation Advisory Committee. These efforts have plainly helped to enhance the effectiveness of the Board of Directors.

- Although a certain amount of progress was observed on discussions about business strategy, it is important to continue to deepen such discussions. In order to achieve the Group Vision and further enhance its effectiveness, it is recognized that this must also lead to formulating specific policy measures, which include optimizing the business portfolio and discussing unprofitable businesses.

- The identification and narrowing-down of the issues to be placed on the agenda for the Board of Directors is an ongoing challenge for appropriately conducting such discussions.

- It has been pointed out that, to deepen discussions, appropriately reviewing past management decisions, and connecting this to future action, are crucial.

- The further enhancement of initiatives for succession planning and training, and the performance evaluation, treatment, etc. of senior management, are thought to be ongoing challenges for discussions of the Board of Directors.

3. Policy for Initiatives for FY2025 to Further Improve Effectiveness

Based on the results of the evaluation in FY2024 and discussions by the Board of Directors, we have formulated the following policies for initiatives for FY2025.

We will strive to improve the effectiveness of the Board of Directors and the Nomination and Compensation Advisory Committee through continuous efforts.

- Policies for initiatives of the Board of Directors

- To realize the NGK Group Vision, the following items shall continue to be regularly reported to, discussed, and monitored by the Board of Directors.

- Overall progress of the medium-term management plan

- Initiatives for transforming our business portfolio

- Progress of New Value 1000 (aiming for sales of 100 billion yen from new commercialized products by 2030)

- Status of company-wide risk management

- IR and SR activities and various committee activities

- Identify issues that should be given priority for discussion, and deepen discussion of business strategies (including for group companies), then connect this to monitoring unprofitable businesses and formulating specific policy measures

- Further enhance opportunities for dialogue between senior management and outside officers, while deepening discussions on succession planning, senior management development, treatment of senior management, etc.

- Policies for initiatives of the Nomination and Compensation Advisory Committee

- Work to further share the status of discussions from the committee to the Board of Directors, while further ensuring the appropriateness of the committee’s discussion process

- Work to further enhance the information provided to the committee related to compensation and nomination

- To realize the NGK Group Vision, the following items shall continue to be regularly reported to, discussed, and monitored by the Board of Directors.

Training Policies for Officers

Directors and Audit & Supervisory Board members have been tasked with the responsibility of exercising the due care of a good manager. NGK therefore has established a training policy of providing the following types of opportunities to sharpen skills and knowledge so that they can fully execute their duties as experts in various kinds of management or as supervisors of business execution.

1.For internal officers: Training on the Companies Act, the Financial Instruments and Exchange Act, competition laws, and other aspects of corporate governance and compliance

2.For outside officers: Mainly providing separate explanations from the department in charge concerning items on the agenda of the Board of Directors and regularly providing information on the business environment and issues as well as opportunities for exchanging opinions

The results for each in FY2024 are as follows.

1.Training on the Companies Act, competition laws, etc. by invited lecturers (2 times in total)

2.Outside officers visit to factories (5 times in total, Nagoya Site, Chita Site, Komaki Site, Ishikawa Plant, R&D facilities)

Briefings before meetings of the Board of Directors and business explanations (14 times in total)

Interviews with executive departments by Audit & Supervisory Board members and outside directors (14 times in total)